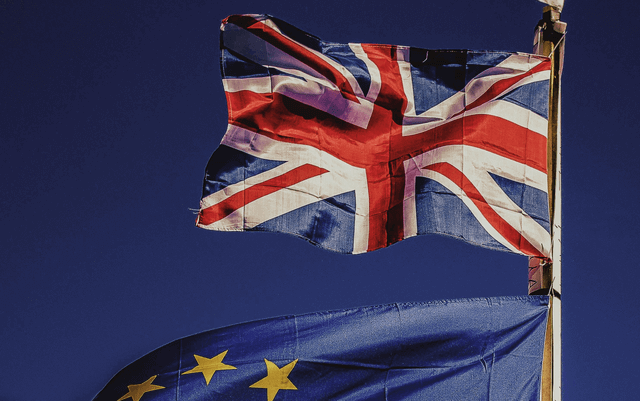

On January 31st, 2020, Britain ceased to be a member of the European Union (EU). The Brexit vote was held in June of 2016. What the voters had to decide was: ‘whether Britain should stay as a member of the European Union or quit the European Union?’ The voters decided to settle on the latter.

Period of Transition

As of now, there will be a period of transition up to December 31st, 2020. Not much will change in that time. The United Kingdom will continue to uphold all of the EU regulations and laws. There will be certain debates on the relationship between the United Kingdom and the EU. Different rules and laws will be applied after the period of transition. The situated is expected to become apparent in 2020.

This will provide time for a new free trade settlement to take place between the UK and the EU, so the products can be moved without paying any extra costs.

Leaving The EU And Starting a UK Company

Now, the bigger question that remains is the impact post-Brexit will have on starting and running a company in the UK? Despite the negotiations going on, one of the questions that might be on the mind of several of the entrepreneurs in the UK will be, if forming a coming post-Brexit is worth any value.

Even if you decide to start a company in the UK, the contracts which are formulated under UK law will stay the same even after the UK fully leaves the EU. So, if you are looking to form a new company, then you can be assured that the UK laws about the formation of the company will remain the same even after the negotiations are done. Listed below are the impacts of forming your own company:

- Limited Liability Company: If you are searching to trade via a limited Liability Company in the UK, then full protective will be provided to your business by the liability offers. Even if your business doesn’t progress, your assets such as bank account, the house, all will be covered by them.

- Separate Entity: Your Company will remain as a separate entity, and will continue to remain active if the founder or director of the business decides to leave.

- Protection of Brand Name: The name of your company will be registered as the official name during the formation of the company process. That means it can’t be used by anyone under your name for trade.

- Tax Efficient: Therefore, UK has always been encouraging about young entrepreneurs starting a new business. That’s why they have the advantage of tax reliefs, which help them a great deal to establish their business.

Conclusion

Therefore, the result of the Brexit on the new companies in the UK will remain the same. That is why it is an increasing chance for more entrepreneurs to launch new businesses.

Form a Company in the UK

Form a Company with Seed Formations and be ready to trade within 24 hours.

from £12.49 + vat